Session #6: Structuring the Deal

Knowing the Difference Between Buying Assets and Buying Equity

Introduction

In today’s session, we’ll cover (arguably) the most important business buying topic:

How to structure your deal!

So, you want to buy a “business”? Exciting stuff!

But, what exactly does that mean? That is, what are you actually buying and why?

It may seem obvious, but maybe not.

Our goal in today’s session is to cover how to structure your deal. That is, how to determine what you’re going to buy, what you’re NOT going to buy, and why!

And to answer those questions, we have to talk about structure.

In this session, we’ll focus on the two most common business buying structures: asset and equity (stock) deals.

It’s possible, however, that you’ll need a more complicated structure, such as a merger, reverse triangular merger or similar. These structures are rare for SMB M&A transactions, so it’s beyond the scope of this course.

Additionally, almost all structuring decisions buyers and sellers make come down to one critical issue: taxes!

Thus, it’s critical to have a tax lawyer or other tax expert as a member of your deal team.

*Note that we’ll address basic tax considerations in this article, but we don’t purport to be tax experts and don’t intend this course to go deep on complicated tax issues. Please consult your own tax expert, as these issues can result in significant cost and expense for the unwary.*

Welcome to the sixth session of the free business buying masterclass.

Let’s get moving!

Did you know that Kevin and Eric have launched a new podcast called Mundane Millionaires?

Each week, we publish and audio and video podcast of interviews with incredible entrepreneurs just like you who building time and financial wealth as entrepreneurs.

This week, we sat down with Kevin Bibelhausen, who recently acquired Heritage Fabrics after a multi-year search saga that included a heartbreaking failed deal in 2018, a near-death experience with Covid-19 that had Kevin receiving end of life care in 2021, and a successful acquisition in early 2023 despite his equity financing falling through the day he was signing his LOI.

You don’t want to miss this episode!

Listen to or watch the latest episode today and please leave us a five star review on your favorite podcasting platforms!

Structuring the Deal

The two main ways an SMB buyer will purchase a business are (1) an equity purchase (or “stock purchase”) or (2) an asset purchase.

Each method has a number of competing commercial, procedural, tax and other considerations that should be weighed, and we’ll examine each below.

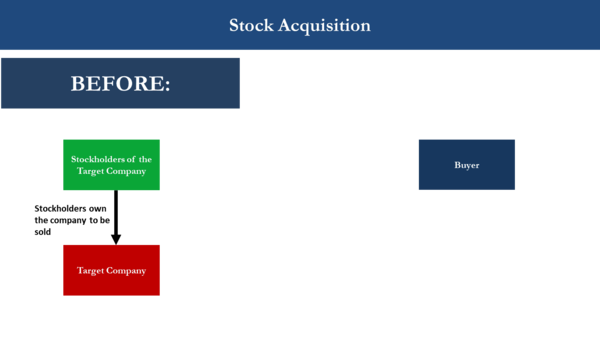

Equity Purchase (or “Stock Purchase”)

An equity purchase is what most people likely picture when they hear the words “buying a business.”

In an equity purchase, the buyer acquires all of some portion of the stock (in the case of a corporation) or membership interests (in the case of an LLC) directly from the selling holders (i.e., the selling business owner) in exchange for cash.

For example, think about what happens on the stock market. This is equity sale or purchase. When you buy a share of Apple Inc. in your brokerage account, you’re buying a piece of ownership of Apple - the actual company itself.

The following is a graphical representation of what the equity purchase process typically looks like:

Commercial Issues

In an equity purchase, the buyer acquires the entire business, warts and all!

The buyer cannot select specific assets and liabilities, and exclude others. Instead, the buyer takes the business in its current form as a going concern.

Sellers typically prefer this structure so that they are not left with any historical liabilities. Sellers also generally prefer the tax treatment of an equity deal, as discussed in greater detail below.

To mitigate the risks associated with acquiring all of the business’ historical liabilities, the buyer will want to maintain the acquired business as a separate entity and negotiate certain protections (such as indemnities, escrows and holdbacks) in the purchase agreement (each of which we’ll review in greater detail later in this course).

One material consideration in equity purchases:

the buyer needs to be sure to acquire all of the equity of the target company (or at least enough to control the target company).

If the buyer does not do this, the buyer may inherit difficult new partners that control the business.

Practice Tip: The first question every searcher should ask is WHO owns the equity of the target business. And be sure to look up the entire chain of ownership. If the target business is owned by other business entities, who owns those other business entities? Review ownership all the way up the chain until you arrive at one or more humans. If any of those owners are hold-out owners, you’ll want to discover that very early in the process!

Process

As discussed below, the equity purchase process is typically much simpler than the asset purchase process, as you don’t need to transfer or assign ownership of each and every asset of the business to the buyer. Instead, all of the assets and liabilities are acquired in one seamless transaction.

Tax

When the buyer acquires the equity of the target business, the tax basis of the underlying assets typically remain unchanged.

The buyer, instead, receives a tax basis in the target company’s equity equal to the purchase price paid (plus certain other items).

The tax basis is then used to calculate the buyer’s taxable income or gain (or loss) on a later sale of the equity.

Buyers typically do not prefer this tax treatment, as it only leaves them the balance of the seller’s tax basis in the assets of the acquired company for depreciation and amortization purposes.

Which, in short, limits the buyer’s ability to reduce its taxable income via depreciation and amortization in the following years.

Here’s a quick example:

If the target owns 50 vehicles with a collectively market value of $500,000, but the target company has already fully depreciated the vehicles, buyer inherits the company with those vehicles fully depreciated. There’s no tax advantage to the buyer to depreciate the $500,000 worth of vehicles just acquired.

In contrast, sellers typically prefer the tax treatment of an equity sale, as the reset of the tax basis associated with an asset acquisition, and the subsequent use of that tax basis by the buyer, can trigger what’s known as “depreciation recapture” and a larger tax bill for the seller.

ASSET PURCHASE

In an asset purchase, the buyer acquires only specific assets and liabilities directly from the target business itself, not from the target business’s owners.

In many cases, the asset purchase agreement will describe the assets to be acquired very broadly (i.e., “all of the assets of the [Business]” with a defined term for “Business”).

However, it’s not uncommon for the asset purchase agreement to include schedules that go to painstaking lengths to list each and every single asset that is included and excluded from the deal.

The following is a graphical representation of what the asset purchase process typically looks like:

Commercial Issues

In an asset purchase, the buyer is given the flexibility to pick and choose the specific assets to be acquired and, obviously, excluded from the deal.

This means that the buyer can avoid acquiring unwanted assets (and their associated historical liabilities).

This does, however, create the risk that the buyer may fail to include in the purchase certain necessary or important assets for the operation of the business after closing. For example, if the buyer mistakenly fails to include certain key agreements or equipment, they may not be able to operate the business in the same manner after closing.

For the same reasons, sellers do not typically prefer this deal structure, as it can result in their being stuck with historical or other liabilities.

Process

The asset purchase process is also typically much more complicated and time consuming than the equity purchase process, as it requires the buyer and seller to identify and assign over each and every purchased asset to the buyer.

If the target company is asset intensive, the transfer and assignment process can become prohibitively burdensome for both parties.

Tax

When the buyer acquires the assets of the target business, the purchase price is allocated among the acquired assets according to a certain agreed upon formula, thus creating a new tax basis in each asset.

These purchase price allocations are typically heavily negotiated and included in a schedule to the purchase agreement and later reflected in the buyer’s and seller’s tax filing.

This tax treatment is typically the buyer’s preference, as it usually creates a stepped-up tax basis in each acquired asset thus creating more opportunity for depreciation and amortization and, consequently, lower taxable income for the buyer in the years following the closing.

This tax treatment can, however, result in greater taxation for the seller, due to the depreciation recapture noted above.

Note that, aside from the allocation and tax treatment of the sale of the assets on a federal tax return, there are additional tax implications to an asset sale, particularly in physical asset-heavy businesses.

For example, if you’re buying a business with a huge fleet of 50 vehicles, in an asset transaction you have to assign the title of all 50 vehicles over to the new business. When you do that, in most states the DMV is going to charge tax on the fair market value of the vehicle. If those 50 vehicles are worth half a million dollars, you’re talking about additional registration fees and taxes of tens of thousands of dollars for those vehicles, which can catch an unsuspecting buyer by surprise and eat into your working capital immediately after closing.

Seek Tax Guidance

If you only take one thing away from this Session, let it be the following:

Making a tax mistake can be very expensive. Be sure to seek tax guidance for your transaction. If you don’t, it may cost you!

Practical Guidance

So when does a stock purchase make sense for a buyer in SMB-land?

The simple answer is (1) whenever an asset deal is not practical due to issues with the transferability of certain assets, including customer or other contracts, or licenses, or (2) whenever the seller demands a stock deal for tax or other reasons.

In all other situations, an asset deal is the baseline expectation in SMB deals.

But, remember when agreeing to a stock deal, more risk means a less valuable acquisition for the buyer.

Don’t be afraid to reflect this in the valuation!

Disclaimers

Now for a few required disclaimers. Sorry in advance!

This course is being presented strictly for educational and informational purposes, and not for the purpose of marketing any legal services or seeking legal employment and is not motivated by pecuniary gain.

The opinions stated in this course from the authors represent the opinions of such individual author and not the opinions of any other person or organization.

Nothing contained in this course or otherwise from the authors hereof is to be interpreted as legal, financial, tax, investment and/or any other form of advice. Please consult your own legal, financial, tax, investment and/or other advisors.

The authors are not your lawyer, and no information provided in the course of this class or otherwise has the affect of forming an attorney-client relationship between you and the authors. In short, get your own lawyer!

This course is being presented by The SMB Center LLC and has no affiliation or relationship SMB Law Group LLP.

About the Authors

The authors have worked for some of the most elite law firms in the world.

During their time in BigLaw, they regularly worked on transactions in the hundreds of millions to billion dollar plus range for some of the most recognizable companies in the world and have extensive experience with M&A.

The authors have since begun investing in select SMB acquisitions and have co-founded an SMB-focused law firm where they’ve collectively worked on hundreds of millions of dollars in SMB-focused M&A.

Such good content hard to find nowadays! Great article!

great info. Question: what is the difference in the paid version vs the free post for M&A Masterclass substack subscription?