The SBA 7(a) Loan Primer Every Buyer Needs

How the program really works... and how to avoid the mistakes that kill good deals.

🧠 Lead Story: The Truth About SBA 7(a) Loans

You hear it all the time:

“Just get an SBA loan and buy a business.”

Sounds simple.

It’s not.

Especially lately, as the SBA has continued to adjust program terms.

If you’re serious about acquiring a small business, the SBA 7(a) loan program is likely your most powerful (and misunderstood) tool.

And if you don’t understand how it works… really works… you’re going to waste time, burn relationships, and potentially lose deals.

Let’s fix that.

It also comes with real risks, that need to be talked about.

Let’s do that.

💸 What Is the SBA 7(a) Program?

It’s a loan guarantee program.

The SBA isn’t giving you money. They’re backing your loan.

Here’s how it works:

You go to a lender (typically a bank or non-bank SBA lender)

The lender gives you up to $5M

The SBA guarantees 75% to 85% of the loan

You use it to buy a business

The SBA’s guarantee reduces the lender’s risk.

Which means they’re more likely to fund your deal — if you follow the rules.

🧾 What Are the Rules?

A lot of buyers mess this up.

Here are the core eligibility requirements:

The business must be small (per SBA size standards)

The buyer must be actively involved (no absentee owners)

You must be a U.S. citizen or permanent resident

You must personally guarantee the loan (more on this below!)

You must put in a minimum 10% equity injection (read: down payment)

But it’s not just about meeting those conditions.

You also have to structure the deal correctly:

✅ Asset purchase (typically)

✅ Seller note on full standby (often)

✅ No earnouts, limited seller rollovers (historically)

✅ Compliant working capital treatment

✅ Specific collateral and lien requirements

We’ll dig into the June 1, 2025 rule changes next week, but for now — understand this:

Structure matters. A lot.

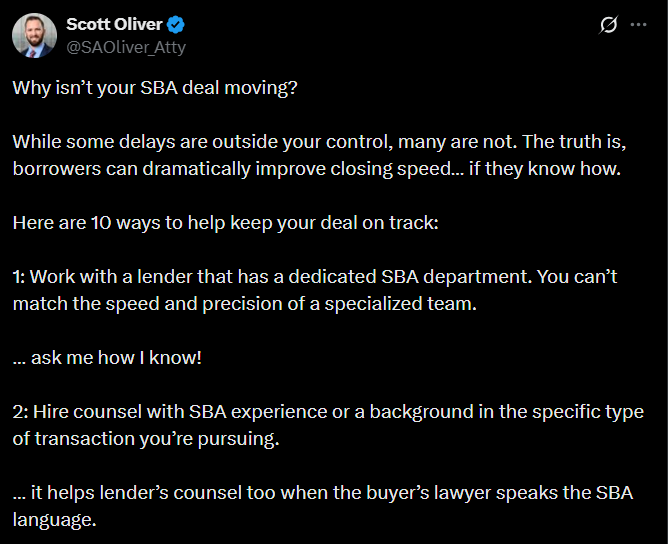

📣 Expert Insight from the Front Lines

Scott Oliver, a leading lender-side attorney at Lewis Kappes, put it bluntly this week:

“There are so many small business acquisitions falling apart right now because the buyers and their counsel don’t understand the SBA rules. The market’s gotten faster — but the bar for precision hasn’t lowered.”

He’s not wrong.

We’re seeing it on our side too:

Deals dragging. Lenders balking. Deadlines missed.

It’s not because buyers are reckless, it’s because they’re uninformed or try to do too much.

📉 What Happens If You Screw It Up?

Bad things.

The lender might pull the loan post-approval

The SBA might deny the guarantee

You could default and still be personally liable

And in the worst cases?

You burn your seller relationship

You waste 6–9 months chasing a dead deal

You end up back at square one with a bruised rep

🏦 What the Best SBA Lenders Do Differently

Not all lenders are created equal.

The best ones:

Pre-underwrite early so you don’t waste time

Understand deal-specific nuance (like working capital, deferred revenue, seller notes, etc.)

Have real relationships with the SBA

Tell you no fast if your deal won’t fly

We have favorites. If you’re in a deal and need a strong SBA partner, just reach out.

👀 What You Need to Do Before the LOI

Here’s what we recommend:

Get pre-qualified with an SBA lender

Understand what you can afford and what they’ll approve

Learn the key issues lenders care about:

Addbacks

Debt service coverage

Industry concentration

Ownership transition

Collateral shortfalls

Avoid structural terms that will kill your deal (more on this next week)

You wouldn’t put a house under contract without knowing if you can get a mortgage.

Same goes here.

📈 Acquisition Insight: SBA Loans Are Powerful — If You Respect the Process

Too many first-time buyers try to force their deal into an SBA box at the last minute.

That’s backwards.

Start with what SBA lenders will actually fund — and work from there.

That means:

Understand your capital stack before diligence

Engage a legal team that knows SBA nuance

Structure your LOI to set the deal up for financing

Don’t chase sellers who refuse to play ball on deal structure

⚠️ The Risks of Taking on SBA Debt

SBA financing can be an incredible lever — but it cuts both ways.

If you default, the SBA doesn't just “take the business.”

They come for your personal guarantee.

That means your house. Your savings. Your paycheck.

And in low-margin or volatile industries, even one bad quarter can create real pressure.

If you want a powerful (and sobering) example, listen to this recent Acquiring Minds episode featuring Justin Willess:

🎧 “I Bought a Construction Company, Then Faced an SBA Loan Default”

Justin shares how a construction business acquisition went sideways — and how the weight of SBA debt shaped every decision after close.

It's a must-listen if you're planning to sign on the dotted line without a margin of error.

📚 Additional Reading on SBA Loan Risk

Nerd Wallet: “What Happens If You Default on an SBA Loan?”

A clear, borrower-friendly overview of the financial and legal consequences of SBA loan default.

👉 https://www.nerdwallet.com/article/small-business/sba-loan-default-know-cant-payForbes: “What Happens If You Can’t Pay Your SBA Loan?”

This dives into how defaults are handled, what the government collects, and what recourse they may take.

👉 https://www.forbes.com/advisor/business-loans/sba-loan-default/

🔍 Legal Spotlight: Our SBA-Ready LOI Template

We’ve helped close over $1B in M&A deals, many of them SBA-financed.

Our LOI template is:

✅ Clean and professional

✅ SBA-compliant

✅ Buyer-favorable

✅ Easy to edit

And if you use it, we’ll finalize it for free when you retain us.

→ Email info@smblaw.group to get a copy.

📦 Next Week: The 6/1 SBA SOP Rule Changes

We’re breaking down everything that changed in the new SOP — and why it matters:

Seller equity rollovers

Preferred equity injections

Personal resource testing

Standby requirement changes

It’s a big deal.

But don’t panic.

We’re decoding it all.

⚠️ Disclaimer

This newsletter is for informational purposes only and does not constitute legal, financial, or investment advice. Certain examples are anonymized and modified for educational purposes only. SMB Law Group is a strategic partner of certain lenders and may benefit financially from referrals.